Amur Capital Management Corporation Can Be Fun For Anyone

Amur Capital Management Corporation Can Be Fun For Anyone

Blog Article

The Best Strategy To Use For Amur Capital Management Corporation

Table of ContentsAmur Capital Management Corporation Fundamentals ExplainedAmur Capital Management Corporation Things To Know Before You Get ThisAmur Capital Management Corporation - An OverviewAmur Capital Management Corporation Can Be Fun For EveryoneAmur Capital Management Corporation for BeginnersThe 45-Second Trick For Amur Capital Management Corporation

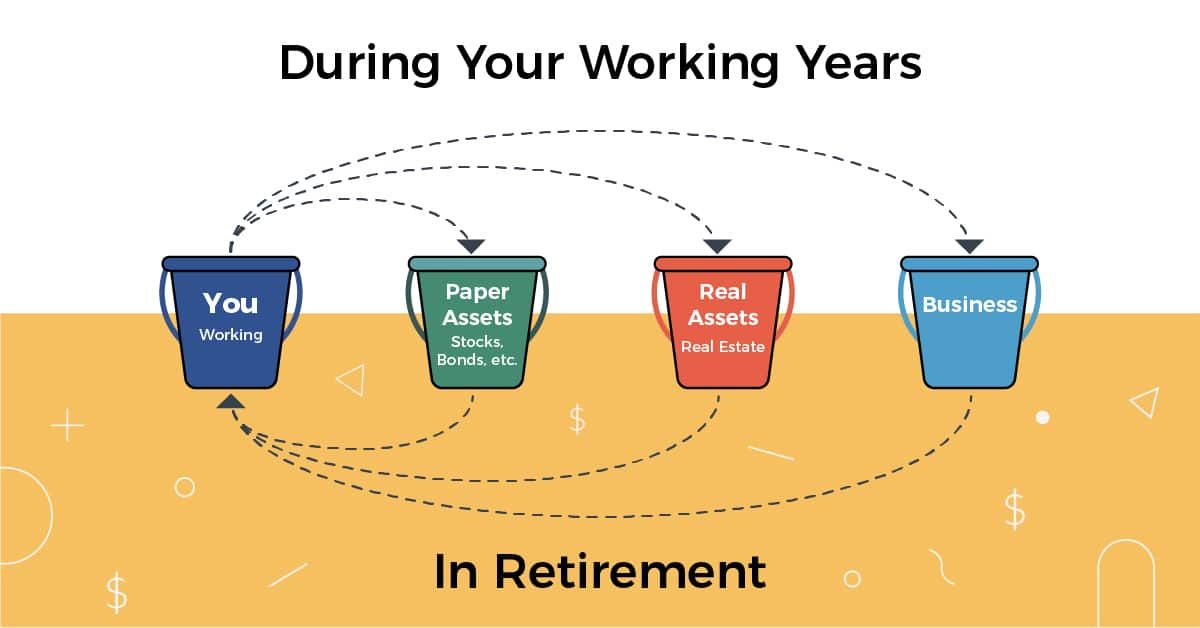

Not just will the home boost in worth the longer you have it, but rental prices typically follow a higher trend too. This makes actual estate a rewarding long-lasting investment. Property investing is not the only way to spend. There are lots of various other investment choices available, and each features its very own set of strengths and weak points.

All About Amur Capital Management Corporation

Smart investors may be awarded in the form of recognition and rewards. In truth, since 1945, the ordinary large supply has actually returned near 10 percent a year. Supplies truly can act as a long-term savings vehicle. That stated, supplies might equally as quickly diminish. They are by no suggests a sure point.

That said, genuine estate is the polar opposite concerning specific aspects. Net profits in genuine estate are reflective of your own actions.

Stocks and bonds, while commonly lumped together, are essentially various from one an additional. Unlike stocks, bonds are not agent of a stake in a company.

The 8-Minute Rule for Amur Capital Management Corporation

The genuine benefit real estate holds over bonds is the moment framework for holding the investments and the rate of return during that time. Bonds pay a set interest rate over the life of the financial investment, therefore purchasing power keeping that passion drops with rising cost of living in time (capital management). Rental home, on the various other hand, can create greater rents in periods of greater rising cost of living

It is as basic as that. There will certainly constantly be a need for the rare-earth element, as "Half of the world's population believes in gold," according to Chris Hyzy, primary investment policeman at united state Depend on, the private wide range management arm of Financial institution of America in New York. According to the World Gold Council, demand softened in 2014.

Amur Capital Management Corporation Fundamentals Explained

Identified as a fairly safe commodity, gold has developed itself as an automobile to enhance investment returns. Some do not even think about gold to be an investment at all, rather a hedge versus rising cost view website of living.

Obviously, as risk-free as gold may be considered, it still stops working to stay as appealing as genuine estate. Here are a few factors capitalists prefer genuine estate over gold: Unlike real estate, there is no financing and, as a result, no room to utilize for development. Unlike genuine estate, gold recommends no tax obligation advantages.

How Amur Capital Management Corporation can Save You Time, Stress, and Money.

When the CD develops, you can collect the original investment, together with some passion. Certificates of deposit do dislike, and they've had a historic ordinary return of 2.84 percent in the last eleven years. Realty, on the various other hand, can value. As their names recommend, common funds contain funds that have actually been merged with each other (investing for beginners in canada).

It is among the easiest ways to diversify any type of portfolio. A shared fund's performance is constantly gauged in terms of overall return, or the amount of the adjustment in a fund's web property worth (NAV), its rewards, and its funding gains circulations over an offered period of time. Nonetheless, much like stocks, you have little control over the performance of your possessions. https://www.slideshare.net/christopherbaker1052.

Positioning cash right into a common fund is essentially handing one's investment choices over to a professional cash manager. While you can pick and select your investments, you have little say over how they carry out. The 3 most common means to spend in property are as adheres to: Purchase And Hold Rehab Wholesale With the worst component of the economic downturn behind us, markets have actually undergone historic recognition prices in the last three years.

The 5-Minute Rule for Amur Capital Management Corporation

Purchasing reduced does not imply what it utilized to, and financiers have acknowledged that the landscape is transforming. The spreads that wholesalers and rehabbers have become accustomed to are starting to summon memories of 2006 when worths were traditionally high (accredited investor). Of course, there are still many possibilities to be had in the world of flipping genuine estate, yet a new exit strategy has become king: rental residential or commercial properties

Otherwise referred to as buy and hold residential properties, these homes feed off today's appreciation rates and take advantage of the reality that homes are more pricey than they were simply a couple of brief years back. The principle of a buy and hold departure strategy is simple: Capitalists will certainly look to enhance their profits by renting the residential or commercial property out and accumulating month-to-month capital or simply holding the residential or commercial property until it can be cost a later day for a revenue, of training course.

Report this page